Portfolio Analytics

The Loan Portfolio Analysis Monitoring Solution

Portfolio Analytics from ValueCheck is a complete data and software solution for lenders to evaluate loan portfolios of first and second mortgages, auto loans and other consumer loans. Portfolio Analytics provides insightful and actionable views, helping lenders to achieve their goals with:

- Portfolio Risk Analysis

- Migration Trend Analysis

- Combined Loan To Value (CLTV) Analysis

- HELOC Analysis and Much More

Discover how your lending institution can benefit from Portfolio Analytics.

Portfolio Analytics Provides Key Benefits

With ValueCheck Portfolio Analytics, you have a full loan portfolio analysis monitoring solution and reporting tool that includes all aspects of the loan data including credit scores, collateral valuation, and borrower specific trends.

Portfolio Analytics offers your organization all of the following benefits:

- Compliance with Interagency Appraisal Guidelines

- Anytime, anywhere monitoring of your credit portfolio

- Visibility into current and potential credit risk exposure

- Flexibility to accept your data in any file format for database integration

- The ability to quantify loan loss exposure for estimating Allowance for Loan and Lease Losses (ALLL)

- The power to identify marketing opportunities for cross selling and up selling

- Ongoing, quarterly valuation updates to your real estate and automobile portfolios

A Robust Database and an Intuitive Web Application

Portfolio Analytics provides a step-by-step workflow to migrate and clean your portfolio data, combined with an intuitive web application that offers secure, 24/7 access to easy-to-understand reports. Instantly, you will have clear visibility into your potential risk and market exposure.

What's more, along with an understanding of your risk you will also be able to identify new marketing opportunities.

According to The Interagency Appraisal and Evaluation Guidelines, an institution should monitor collateral risk on both a portfolio basis and on an individual credit basis.

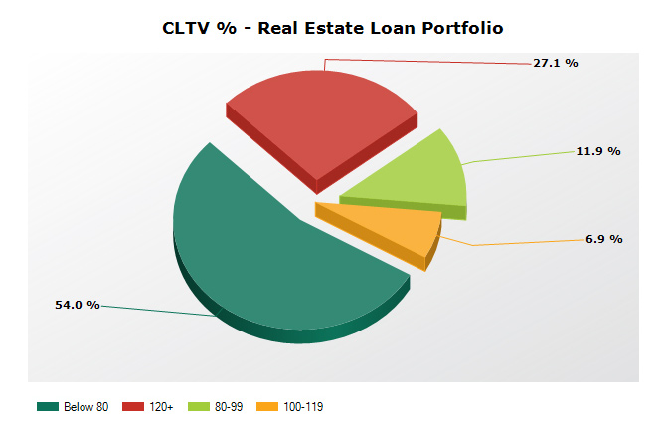

Portfolio Analytics provides insightful charts, such as Combined Loan to Value (CLTV), an instrumental metric in determining the at risk amount.

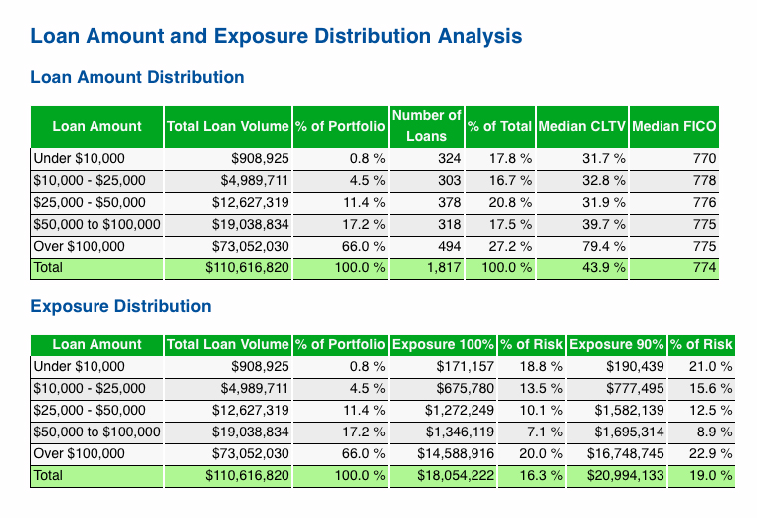

The Loan Amount and Exposure Distribution Analysis report provides a critical component to understanding how to prioritize the risk associated with your loan portfolio.

A Comprehensive Suite of Reports and Charts

With Portfolio Analytics, you get a comprehensive suite of reports and charts, providing insightful and actionable views into your loan portfolio, with full coverage in all of the following categories:

- Concentration Analysis

- Portfolio Risk Analysis

- Migration Trend Analysis

- Negative Equity, High Risk Loans

- Negative Equity, Low Risk Loans

- HELOC Analysis

- FICO Drop > 10%

- CLTV Deterioration > 10%

A Focus on Your Data

At ValueCheck, we pride ourselves on being a Data company. As we build your database over time, our focus is on complete and clean data.

Our team of data experts carefully address mismatches during the data cleansing process.

Our proprietary process provides for correcting these mismatches, filling in missing data, and enabling you to update and revise data going forward.

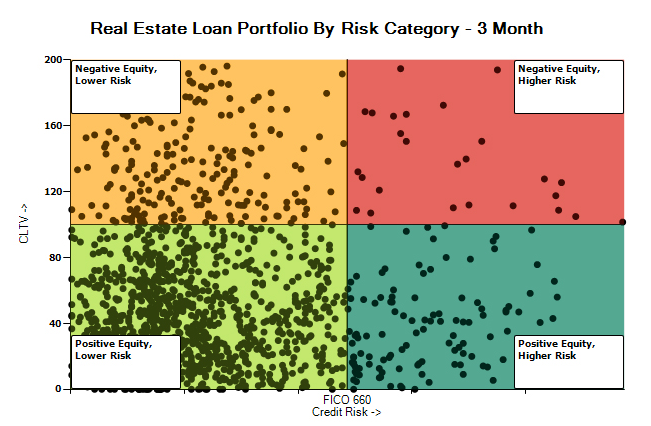

This chart plots the loans within a portfolio by risk category. The combination of borrower and real estate market based risk is extremely powerful as the intersection of these two types of risk can demonstrate opportunity or potential problems.

Portfolio Analytics —The Complete Credit Union Solution

Portfolio Analytics is the complete credit union solution, ideal for monitoring loan portfolios, preparing for NCUA examinations, conducting stress tests and also identifying marketing opportunities.