Solutions for Lenders

Comprehensive Data and Analytic Software

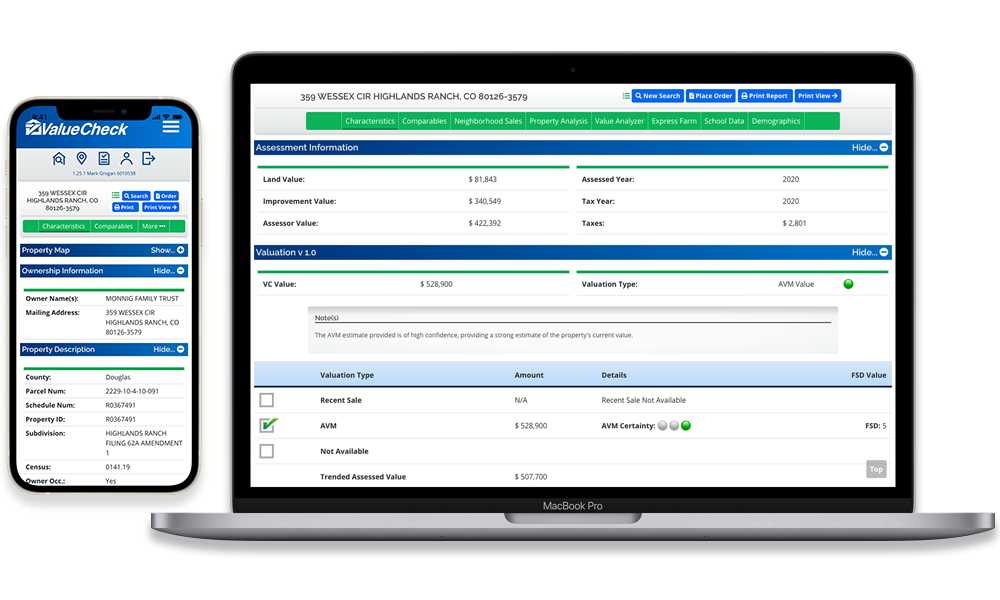

ValueCheck provides data and analytic software solutions to Credit Unions and Mortgage Lenders, helping them to:

- Make faster, data-driven real estate lending decisions

- Value a property with accuracy

- Manage loan portfolios with insightful, ongoing analytics

- Increase loan volume while decreasing overall risk

Discover how your business can benefit from our wide-ranging services and software.

A Growing Suite of Services and Product Enhancements

At ValueCheck, we're always looking for new opportunities to deliver the data and services that help our clients get work done. Shown below are some recent additions to our growing suite of offerings.

National Coverage

We've recently achieved a new milestone — Our property database now covers the entire country.

Appraisal Products & Services

You can access appraisal products through our strategic alliance with SWBC Lending Solutions™.

HVE® Valuations

We've integrated HVE® Valuations from Freddie Mac into the ValueCheck product.

Combined Loan-to-Value (CLTV)

Our loan data provides current CLTV ratios for quick and easy loan pre-qualifications.

HELOC Calculator

Capture a HELOC lead — find out how much the homeowner can qualify for in just 2 clicks!

Enhanced Data for Marketing

Our expanded data sets provide unique insights for upselling to your clients and expanding your geographic footprint.

A Full Range of Lender Services

At ValueCheck, we've been in the business of providing lender services for over 15 years. From property profiles to automated valuations and more, we provide the services lenders need.

-

National Real Estate Data

-

Automated Order Placement & Tracking

-

Home Equity Calculator

-

Property Valuations

-

Property Condition Reports

-

Evaluations

-

Appraisals

-

Flood Hazard Determinations

Solutions for the Lending Industry

Discover the Value

We provide the comprehensive services that lenders need and rely on every day.

Our product offerings cover both residential and commerical properties.

From detailed Property Condition Reports, to eValuations and more, lenders turn ValueCheck for accurate and informative data — to make sound lending decisions.

Easy-to-Use Software Tools

Our software solutions help lenders quickly get answers to their most pressing questions.

With our modern and easy-to-use software tools you can...

- Research properties and accurately determine values

- Manage your loan portfolio and monitor risk

- Market new product offerings to your customer base

- And much more

Find out how our solutions can have a positive impact on your business.

Backed by an Expert Team

Our team is made up of industry and data experts, with a focus on data quality and best-in-class customer service.

When you choose ValueCheck, you can make the choice with confidence and trust.

Training Classes Are Available

The ValueCheck team also offers in-depth training classes. So you can learn how to navigate and interpret the vast amounts of real estate data.

ValueCheck — Discover the Value.